Class Action Claims State Auto Tricked Policyholders into Paying for ‘Illusory’ Insurance Coverage

by Erin Shaak

Travis v. State Automobile Mutual Insurance Company, Inc. et al.

Filed: December 9, 2021 ◆§ 5:21-cv-05395

State Auto Group faces claims that it stole money from customers by duping them into paying for extra insurance coverage already included in their policies.

State Automobile Mutual Insurance Company, Inc. State Auto Insurance Company Milbank Insurance Company

Pennsylvania

State Auto Group faces a proposed class action over an alleged scheme to steal money from customers by duping them into paying for extra insurance coverage that was already included in their policies.

The 36-page case says that State Automobile Mutual Insurance Company, Inc. and two subsidiaries offer dwelling fire insurance policies marketed toward owners of rental properties or seasonal, vacation or secondary homes. The suit states that the policies purport to provide coverage for damage caused by wind, lightning, hail, fire, explosion and vandalism. According to the suit, the defendants perpetrated between 2015 and July 2021 a “complex, closed-end” scheme whereby they sold “phantom” insurance through a website portal called State Auto Connect that, despite being advertised as a technological advancement, was in reality “the centerpiece of an elaborate scam.”

The lawsuit more specifically alleges that the State Auto Connect portal included checkboxes for lines of coverage that were already included in the base coverage of customers’ dwelling fire policies. These extra lines, which included purported coverage for “Other Structures,” “Fair Rental Value” and “Additional Living Expenses,” existed only to allow the defendants to collect extra money in premiums without incurring any additional risk, the complaint alleges.

The lawsuit, which alleges violations of the Racketeer Influenced and Corrupt Organizations (RICO) Act, estimates that State Auto Group amassed “tens of thousands of illegal premium payments” from customers between 2016 and 2021.

Though the defendants allegedly attempted to cover up their scheme by making “updates” to the Connect platform and revising declarations pages in July 2021, the case alleges that they have failed to reimburse policyholders for the unlawfully collected premium payments.

The defendants’ dwelling fire policies, the lawsuit explains, include five lines of coverage that include:

- “Dwelling” coverage for the dwelling located on a property;

- “Other Structures” coverage for structures such as garages, driveways, pool houses, or gazebos on a property;

- “Personal Property” coverage for personal property “usual to the occupancy as a dwelling”;

- “Fair Rental Value” coverage for the fair rental value if a property is unfit for use due to a covered peril; and

- “Additional Living Expenses” coverage for necessary increases in living expenses due to a covered peril.

Per the suit, when an individual purchases Section A Dwelling coverage, 10 percent of that coverage is automatically included for Section B Other Structures, and 20 percent is automatically included for Sections D and E.

“In other words, State Auto automatically included insurance coverage for Sections B, D & E within the base purchase of Section A,” the complaint says.

Moreover, the lawsuit claims that the defendants capped coverage limits for Sections B, D and E at the amount automatically included with Section A coverage. Therefore, policyholders were not permitted to increase coverage for other structures, fair rental value and additional living expenses beyond the limits already included with their base dwelling coverage, according to the case.

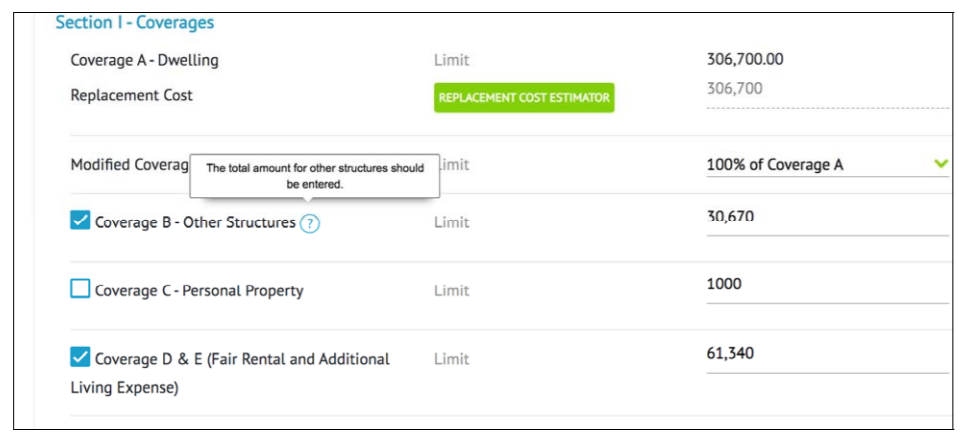

The suit alleges, however, that the quote screen on State Auto’s Connect platform between 2016 and July 2021 included checkboxes next to Sections B through E that deceived policyholders into thinking they had to select each section in order to receive coverage for each line item. Per the case, the quote screen (displayed below) contained no explanation that coverage for Sections B, D and E were automatically included in the policy.

When a customer selected coverage for Section B or D and E, the cost of their premium payment increased even though they were receiving no additional increase in coverage, according to the complaint.

“Policyholders were paying extra for coverage they were already entitled to,” the suit scathes.

The lawsuit further alleges that the declarations page provided to each policyholder to summarize their insurance coverage was similarly misleading and contained no disclosure that coverage for Sections B, D and E were automatically included.

According to the case, the defendants attempted to cover up their purported scheme to deceive policyholders by announcing “changes” to their Connect platform in July 2021. The suit says these changes included additional disclosures on the Connect platform quote page and each policy’s declarations page and the elimination of the defendant’s cap on coverage for other structures, fair rental and additional living expenses.

Prior to the inclusion of these additional disclosures on the Connect platform and declarations page, the defendants “purposefully concealed” what was actually included in customers’ insurance purchases, the lawsuit argues. As the complaint tells it, “[n]o reasonable policyholder would check the box and pay extra for coverage that was already included.”

The case looks to represent State Auto dwelling fire policyholders who purchased “B. Other Structures” coverage and/or “D. Fair Rental Value” and “E. Additional Living Expenses” coverages through the Connect Platform prior to July 2, 2021.

Get class action lawsuit news sent to your inbox – sign up for ClassAction.org’s newsletter here.

Video Game Addiction Lawsuits

If your child suffers from video game addiction — including Fortnite addiction or Roblox addiction — you may be able to take legal action. Gamers 18 to 22 may also qualify.

Learn more:Video Game Addiction Lawsuit

Depo-Provera Lawsuits

Anyone who received Depo-Provera or Depo-Provera SubQ injections and has been diagnosed with meningioma, a type of brain tumor, may be able to take legal action.

Read more: Depo-Provera Lawsuit

How Do I Join a Class Action Lawsuit?

Did you know there's usually nothing you need to do to join, sign up for, or add your name to new class action lawsuits when they're initially filed?

Read more here: How Do I Join a Class Action Lawsuit?

Stay Current

Sign Up For

Our Newsletter

New cases and investigations, settlement deadlines, and news straight to your inbox.

Before commenting, please review our comment policy.